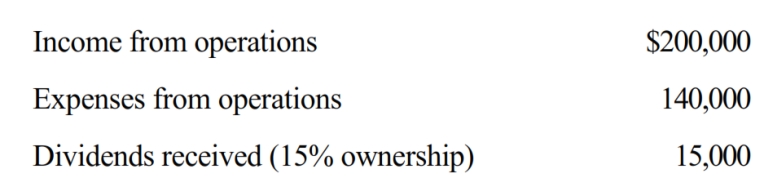

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Mississippi Valley

A region in the United States surrounding the Mississippi River, known for its significant historical and geographical features.

Civil Law

The body of laws that govern the rights and responsibilities either between persons or between persons and their government.

Rights Violated

Instances where an individual's legally protected freedoms or entitlements are infringed upon.

Criminal Law

The body of law that relates to crime and prescribes conduct perceived as threatening, harmful, or otherwise endangering to the property, health, safety, and moral welfare of people.

Q14: Pursuant to a liquidation, Coral Corporation distributes

Q17: The taxpayer had consistently used the cash

Q35: Brown Corporation, an accrual basis corporation, has

Q37: Tammy has $200,000 of QBI from her

Q61: For tax years beginning before 2018, the

Q66: Perry organized Cardinal Corporation 10 years ago

Q81: Albatross, a C corporation, had $140,000 net

Q106: Gerald, a cash basis taxpayer, owns 70%

Q125: Leon owns 750 shares of the 2,000

Q150: A partnership cannot use the cash method