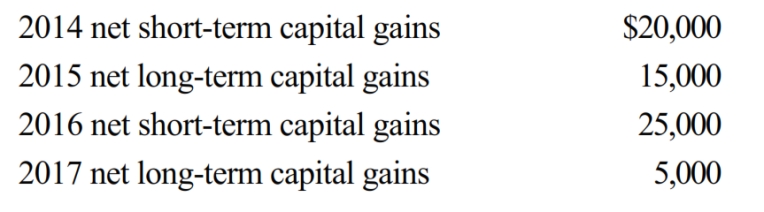

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2018. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2018 tax return?

b. Determine the amount of the 2018 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2018 tax return?

Definitions:

Price Conscious

Being aware of and giving importance to the cost of goods and services when making purchasing decisions.

Demand

The desire combined with purchasing power for specific goods or services at a given time and price.

Lunchbox

A container used to carry food, often for consumption at work or school.

Revenue

the total amount of money received by a company for goods sold or services provided during a certain period.

Q3: In 2018, Bluebird Corporation had net income

Q68: Business equipment is purchased on March 10,

Q99: In general, the basis of property to

Q100: Which of the following real property could

Q105: Which of the following statements is incorrect

Q108: Which of the following statements is correct

Q147: Provide a brief outline on computing current

Q192: Which one of the following allocations is

Q244: Fran was transferred from Phoenix to Atlanta.

Q268: When a property transaction occurs, what four