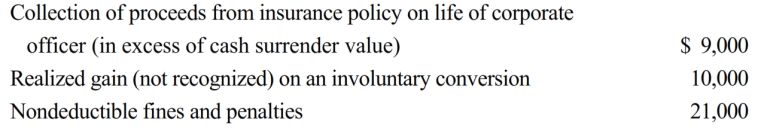

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Definitions:

Flow of Matter

The movement and cycling of chemical elements and compounds in different forms across various components of the Earth's ecosystem.

Life

A characteristic that distinguishes physical entities with biological processes, such as signaling and self-sustaining processes, from those that do not.

Dissolved Ozone

Ozone that is dissolved in water, used as a disinfectant for treating drinking water or in swimming pools to kill bacteria and other microorganisms.

Aquatic Ecosystems

Water-based environments, including oceans, rivers, lakes, and wetlands, where plants and animals interact within a hydrological system.

Q15: Dr. Stone incorporated her medical practice and

Q20: Aaron is the sole shareholder and CEO

Q32: Grackle Corporation, a personal service corporation, had

Q32: Explain the stock attribution rules that apply

Q51: What are some of the issues remaining

Q68: The basis for the acquiring corporation in

Q69: An S corporation shareholder's stock basis includes

Q71: A C corporation that does not have

Q85: Saleh, an accountant, is the sole shareholder

Q112: Shareholders owning a(n) of shares (voting and