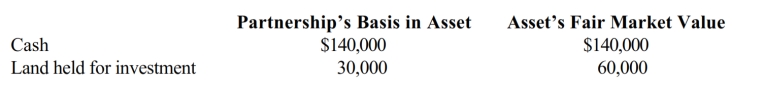

Connie owns a one-third capital and profits interest in the calendar-year CDB Partnership. Her adjusted basis for her partnership interest was $120,000 when she received a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Connie's recognized gain or loss on the distribution, if any.

b. Calculate Connie's basis in the land received.

c. Calculate Connie's basis for her partnership interest after the distribution.

Definitions:

Present Moment

The state or experience of being fully aware of and focused on what is happening right now, without distraction by thoughts of the past or future.

Consciousness Raising

A technique used in various self-help and social movements aimed at increasing awareness about particular issues or aspects of one's self.

Stimulus Control

A technique in behavior therapy aimed at modifying behavior by changing the environmental cues or stimuli that trigger that behavior.

Formal DBT

Dialectical Behavior Therapy in a structured and standardized format, focusing on teaching behavioral skills to manage emotions and improve relationships.

Q7: Faith Church, a § 501(c)(3) organization, operates

Q18: Federal depreciation deduction in excess of state

Q24: With respect to typical sales/use tax laws:<br>A)

Q49: Penguin Corporation purchased bonds (basis of $190,000)

Q108: Which item is not included in an

Q110: Rattler, Inc., an exempt organization, trains disabled

Q119: Briefly describe the rationale for the reduced

Q150: A partnership cannot use the cash method

Q155: Maria owns a 60% interest in the

Q179: Charitable contribution carryforward deducted in the current