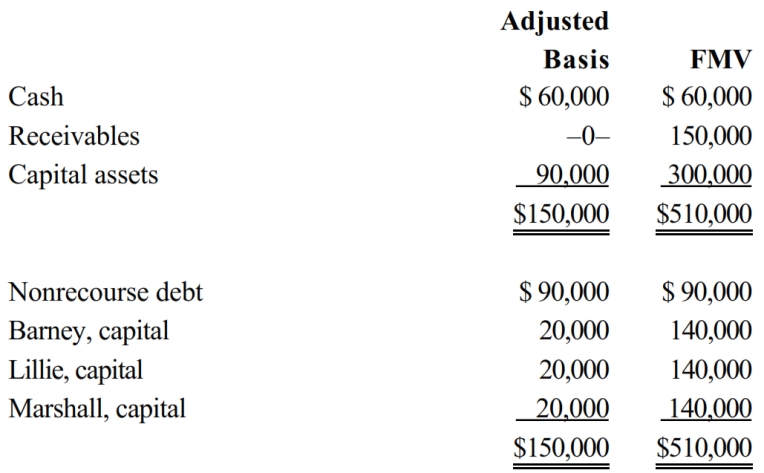

The BLM LLC's balance sheet on August 31 is as follows.

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

Definitions:

Analytical Skills

The ability to collect and analyze information, solve problems, and make decisions based on the available data.

Problem Solving

The process of identifying a problem, devising and implementing a solution, and evaluating the outcome.

Family Engagement

The involvement of families in their children's education and learning, recognizing their value as partners in educational success.

Behavioral Challenges

Behavioral Challenges refer to difficulties or disorders that affect an individual's behavior, often manifesting as disruptive, aggressive, or non-compliant actions in various settings.

Q18: In a proportionate liquidating distribution of his

Q39: The income from a bingo game or

Q44: The corporate-level tax on recognized built-in gains

Q59: General Corporation is taxable in a number

Q78: Which statement is incorrect with respect to

Q93: Maria and Christopher each own 50% of

Q102: Q adopts a sales-only apportionment formula.

Q114: Midnight Basketball, Inc., an exempt organization that

Q157: To determine E & P, some (but

Q167: Rust Corporation distributes property to its sole