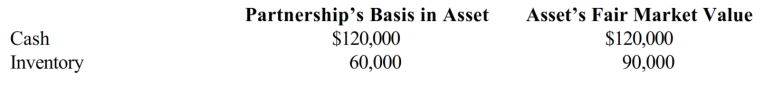

Randy owns a one-fourth capital and profits interest in the calendar-year RUSR Partnership. His adjusted basis for his partnership interest was $200,000 when he received a proportionate nonliquidating distribution of the following assets.

a. Calculate Randy's recognized gain or loss on the distribution, if any. Explain.

b. Calculate Randy's basis in the inventory received.

c. Calculate Randy's basis for his partnership interest after the distribution.

Definitions:

Common Law

A legal system based on custom, court rulings, and past legal precedents rather than statutory laws.

Contract Law

The body of law that regulates the formation, performance, and enforcement of contracts between parties.

Sales Differ

Refers to the variation or discrepancy in sales outcomes, often used to analyze or report on different performance metrics.

Parol Evidence Rule

A legal principle that prevents parties to a written contract from presenting extrinsic evidence of terms of the contract that contradict, modify, or vary contractual terms agreed to in writing.

Q27: Gallery, a public charity, reports annual gross

Q47: § 501(c)(6) business league

Q56: Only 51% of the shareholders must consent

Q59: General Corporation is taxable in a number

Q83: To determine current E & P, taxable

Q98: Meal expense not deducted in 2018 because

Q109: Laura is a real estate developer and

Q109: For transfers falling under § 351, what

Q135: Typically, state taxable income includes:<br>A) Apportionable income

Q167: Which one of the following is an