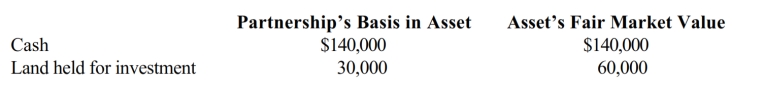

Connie owns a one-third capital and profits interest in the calendar-year CDB Partnership. Her adjusted basis for her partnership interest was $120,000 when she received a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Connie's recognized gain or loss on the distribution, if any.

b. Calculate Connie's basis in the land received.

c. Calculate Connie's basis for her partnership interest after the distribution.

Definitions:

Conversion Costs

The costs incurred to convert raw materials into finished products, which typically include labor and manufacturing overhead expenses.

Painting Department

A specialized division within a manufacturing facility dedicated to paint-related processes or operations.

Weighted-Average Cost Method

An inventory valuation method that assigns a weighted average cost to each unit of inventory, used to calculate cost of goods sold and ending inventory value.

Conversion Costs

The combined costs of direct labor and manufacturing overheads incurred to convert raw materials into finished products.

Q7: The starting point in computing state taxable

Q13: The partnership agreement might provide, for example,

Q26: In determining taxable income for state income

Q45: No E & P adjustment is required

Q59: Limited liability company

Q70: § 501(c)(4) civic league

Q81: Corporate shareholders generally receive less favorable tax

Q100: Define a private foundation.

Q110: Rattler, Inc., an exempt organization, trains disabled

Q160: Josh has a 25% capital and profits