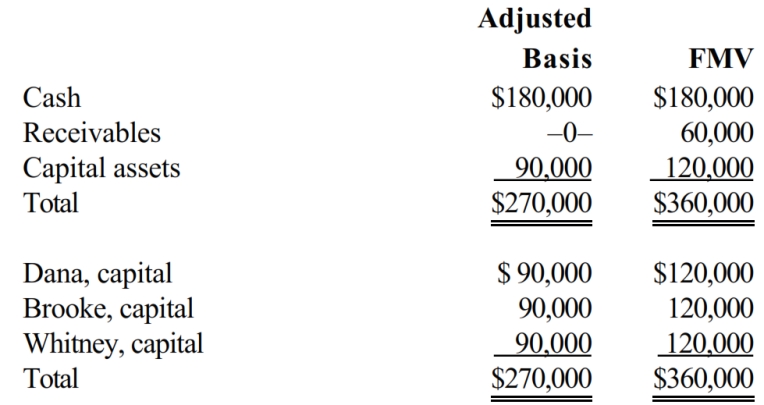

The December 31, balance sheet of DBW, LLP, a service-providing partnership, is as follows.

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

Definitions:

Cross-Cultural Leadership

The process of leading across cultures.

Different Cultures

Refers to the diversity of traditions, values, and practices that characterize various societies around the world.

Formal Authority

The power granted to an individual or a role by a system or organization, typically through a recognized and official position.

Online Resources

Digital materials and services accessible through the internet, used for informational, educational, or recreational purposes.

Q8: Mock Corporation converts to S corporation status

Q25: Compute Still Corporation's State Q taxable income

Q31: Tax on excess business holdings

Q66: A typical state taxable income subtraction modification

Q91: Taylor's basis in his partnership interest is

Q109: As of January 1, Cassowary Corporation has

Q171: Scarlet Corporation is an accrual basis, calendar

Q176: A corporate shareholder that receives a constructive

Q201: The December 31 balance sheet of the

Q210: Limited liability partnership