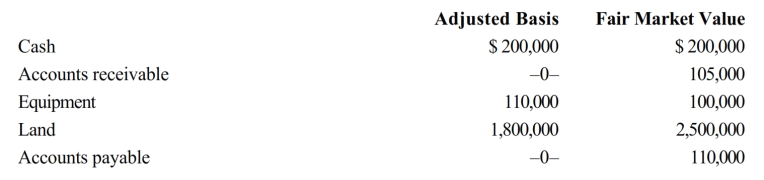

Alomar, a cash basis S corporation in Orlando, Florida, holds the following assets and liabilities on January 1, 2019, the date the S election is made.

During the year, Alomar collects the accounts receivable and pays the accounts payable. The land is sold for $3 million, and the taxable income for the year is $590,000. Calculate any built-in gains tax.

Definitions:

Object Permanence

The understanding that objects continue to exist even when they cannot be observed (seen, heard, touched, smelled, or sensed in any way).

Impossible Events

Occurrences that defy the laws of nature, logic, or reality, often found in fiction or theoretical discussions.

Hand Gestures

Movements of the hands and arms that are used to communicate expressions, emotions, or information without verbal speech.

Object Permanence

The understanding that objects continue to exist even when they cannot be seen, heard, or otherwise sensed, which is an important milestone in cognitive development.

Q18: Stock basis first is increased by income

Q47: § 501(c)(6) business league

Q59: Form 990.

Q69: Some of the states use, in determining

Q90: What are the requirements that must be

Q100: The exclusion of gain on disposition of

Q112: A CFC's profits from sales of goods

Q118: Typically exempt from the sales/use tax base

Q184: On June 30 of the current tax

Q248: Tim and Darby are equal partners in