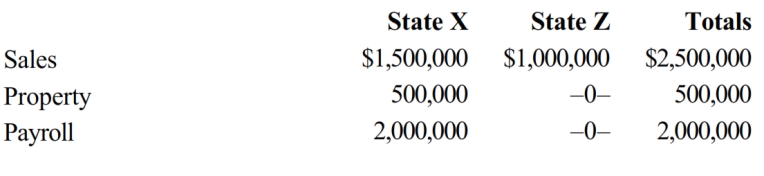

José Corporation realized $900,000 taxable income from the sales of its products in States X and Z. José's activities in both states establish nexus for income tax purposes. José's sales, payroll, and property among the states include the following.

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

Definitions:

Voir Dire

A preliminary examination of prospective jurors by a judge or attorneys to ensure they can judge impartially in a case.

Challenges

Difficult situations or obstacles that require a solution or overcoming.

Jury Selection

The process of questioning and choosing jurors from a pool of candidates to serve on a jury during a trial.

Competitive Industry

A Competitive Industry is characterized by many producers and consumers with the products being largely similar, leading to minimal ability for firms to set prices higher than market rates.

Q1: The IRS pays interest on a refund

Q16: The following income of a foreign corporation

Q16: What is the purpose of the "broadly

Q43: Since loss property receives a _ in

Q52: Form 1024

Q76: Individual who is not a U.S. citizen

Q79: The maximum number of actual shareholders in

Q124: Fiona, a VITA volunteer for her college's

Q146: An assembly worker earns a $50,000 salary

Q174: The _ tax levied by a state