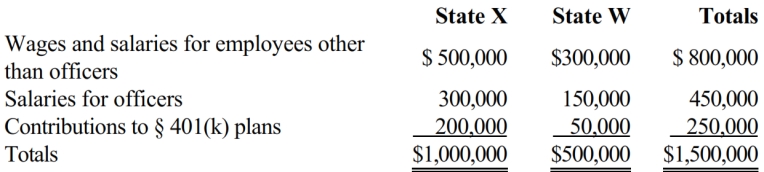

Trayne Corporation's sales office and manufacturing plant are located in State X. Trayne also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including elective contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Trayne incurred the following personnel costs.

Trayne's payroll factor for State X is:

Definitions:

Budgeted Manufacturing Overhead

The estimated total indirect costs related to the production process, planned for a specific period.

Cost Driver

A factor that causes or relates to a change in the cost of an activity or a product, such as machine-hours, labor-hours, or material usage.

Work in Process Inventory

Items or materials that are partway through the production process but not yet completed, representing a current asset on the balance sheet.

Finished Goods Inventory

Items that have completed the manufacturing process and are ready for sale to customers.

Q12: Because he undervalued property that he transferred

Q43: Since loss property receives a _ in

Q72: Yvonne is a citizen of France and

Q95: Juanita, who is subject to a 40%

Q98: Liang, an NRA, is sent to the

Q100: GlobalCo, a foreign corporation not engaged in

Q102: Q adopts a sales-only apportionment formula.

Q122: Which of the following is not a

Q127: An S shareholder's stock basis is reduced

Q138: Which of the following statements is true,