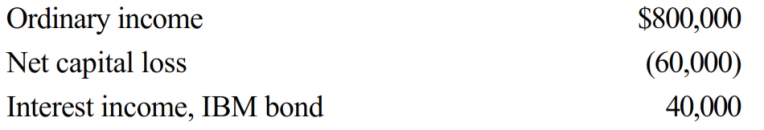

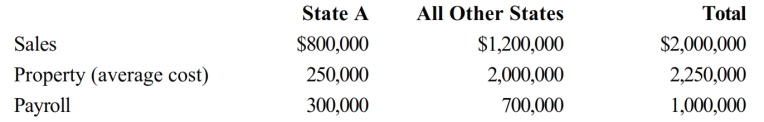

You are completing the State A income tax return for Quaint Company, LLC. Quaint operates in various states, showing the following results.

In A, all interest is treated as apportionable income. A uses a sales-only apportionment factor. Compute Quaint's A taxable income.

Definitions:

Customer Lifetime Value

An estimation of the total value a business can expect from a single customer throughout the entirety of their relationship.

Net Present Value

A financial metric assessing the profitability of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows.

Customer Relationship

The interactions and engagement between a business and its customers, aiming to improve satisfaction, loyalty, and ultimately sales.

Direct Marketing

A type of advertising strategy that involves communicating directly with targeted customers through various channels to promote products or services.

Q20: A negligence penalty can be waived if

Q65: Rachel owns an insurance policy on the

Q78: Willful and reckless conduct.

Q79: Trusts can select any Federal income tax

Q85: Which statement does not correctly describe the

Q88: With respect to income generated by non-U.S.

Q93: During an audit, the IRS might require

Q105: Faye, a CPA, is preparing Judith's tax

Q144: Almost all of the states allow _

Q201: Parent and Minor form a non-unitary group