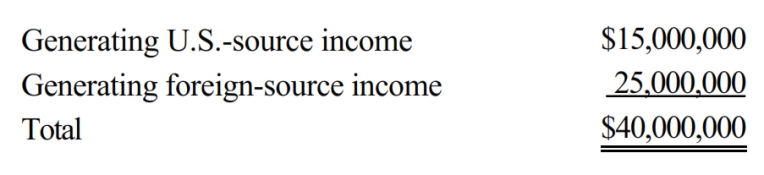

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax basis) are as follows.

Goolsbee incurs interest expense of $200,000. Apportion interest expense to foreign-source income.

Definitions:

High-calorie Items

Foods or beverages that are densely packed with calories, often with high levels of fat or sugar.

Marginal Utility

The additional satisfaction or benefit (utility) a consumer receives from consuming one additional unit of a good or service.

Price of Diamonds

The cost at which diamonds are sold or bought, influenced by several factors including quality, supply, and demand.

Price of Water

The cost assigned to water consumption, varying based on location, availability, and delivery methods.

Q2: R adopts an increase in its statutory

Q17: Circular 230 applies to all paid tax

Q29: Your client holds foreign tax credit (FTC)

Q36: Some states impose inheritance taxes, but the

Q61: Quon filed his Federal income tax return

Q70: Which of the following situations requires the

Q88: Interest on municipal bonds accrued after death.

Q90: The Drabb Trust owns a plot of

Q110: Manfredo makes a donation of $50,000 to

Q116: Wood, a U.S. corporation, owns Holz, a