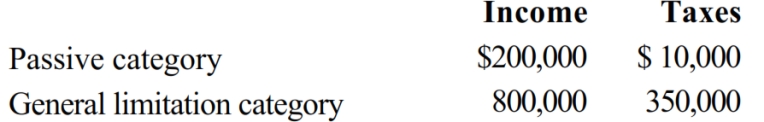

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $336,000 (assume a 21% tax rate). What is Britta's U.S. tax liability after the FTC?

Definitions:

Estrogens

A group of steroid hormones that play a key role in the development and regulation of female reproductive system and secondary sexual characteristics.

Sexual Differentiation

The process by which the differences between males and females are established, guided by genetic, hormonal, and environmental factors.

Prenatal Development

The process of growth and development within the womb from conception to birth.

Hormones

Chemical messengers produced by glands in the body, coordinating and regulating the activities of various cells and organs.

Q15: A letter ruling should be requested when

Q39: The income from a bingo game or

Q50: State Q wants to increase its income

Q52: State income taxes accrued prior to death.

Q78: A tenancy by the entirety is restricted

Q94: Boot Corporation is subject to income tax

Q105: The entity's AMT preferences and adjustments pass

Q121: Hendricks Corporation, a domestic corporation, owns 40

Q143: The Doyle Trust reports distributable net income

Q158: Marquardt Corporation realized $900,000 taxable income from