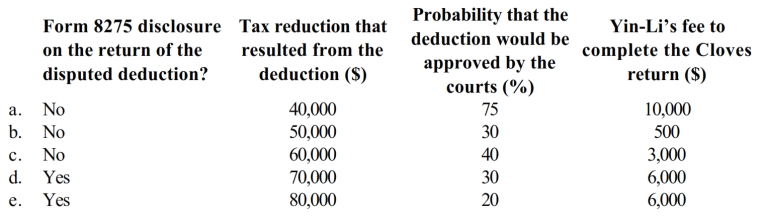

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Debit Card

A payment card that deducts money directly from a consumer’s checking account to pay for a purchase.

Zero-balance Account

A checking account in which a balance of zero is maintained by automatically transferring funds from a master account in an exact amount to cover checks presented.

Float Management

Strategies employed by companies to manage the time between issuing and cashing payments to optimize available cash flow.

NPV

NPV is a calculation that determines the expected financial profitability of a given investment or project by assessing the difference between the current value of all incoming and outgoing cash flows.

Q6: Maria's AGI last year was $95,000. To

Q64: Troy, an S corporation, is subject to

Q74: The sole purpose of government,according to John

Q76: All of the charitable organizations that qualify

Q89: At the time of his death, Jason

Q96: In full settlement of her marital rights,

Q101: The Brighton Trust has distributable net income

Q105: The entity's AMT preferences and adjustments pass

Q146: A(n) _ must obtain a Preparer Tax

Q154: Franz Corporation is based in State A