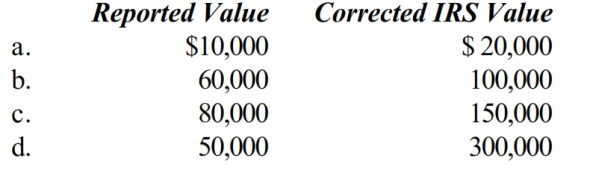

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate. In each case, assume a marginal Federal estate tax rate of 40%.

Definitions:

Trade Barriers

Regulations or policies implemented by a country to restrict or control international trade and protect domestic industries.

IACs

International Advisory Committees, which are groups of experts from various countries providing advice and guidance on global issues or projects.

DVCs

This abbreviation can stand for "Dynamic Voltage and Frequency Scaling," an energy-saving technique in computing, but in economic terms, NO.

Infrastructure

The interconnected network of large-scale capital goods (such as roads, sewers, electrical grids, railways, ports, and the Internet) needed to operate a technologically advanced economy.

Q3: Federal taxable income is used as the

Q14: Kim Corporation, a calendar year taxpayer, has

Q15: According to James Q.Wilson,an "intense commitment to

Q41: Among the most important ends of government

Q48: Which of the following is a typical

Q50: Pluralism is a political philosophy supporting the

Q89: The _ tax usually is applied at

Q120: Maggie purchased an insurance policy on Jim's

Q135: The deduction for the Sharma Trust's $100,000

Q139: PlantCo is a company based in Adagio.