Essay

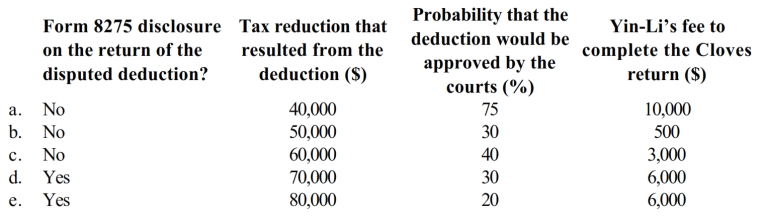

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Related Questions

Q39: Julio, a nonresident alien, realizes a gain

Q40: Hector transfers funds to his aunt so

Q89: Attorneys are allowed an "attorney-client privilege" of

Q96: The IRS targets high-income individuals for an

Q106: About % of all Forms 1040 are

Q111: On the issue of slaves,the Constitution specified<br>A)that

Q121: A garment purchased by an employee for

Q134: Which of the following statements regarding the

Q156: The IRS is one of the largest

Q164: Carole, a CPA, feels that she cannot