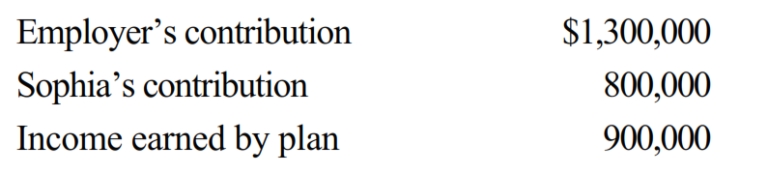

At the time of her death, Sophia was a participant in her employer's qualified pension plan. Her accrued balance in the plan is as follows.

Sophia also was covered by her employer's group term life insurance program. Her policy (maturity value of $100,000) is made payable to Aiden (Sophia's husband). Aiden also is the designated beneficiary of the pension plan.

a. Regarding these assets, how much is included in Sophia's gross estate?

b. In Sophia's taxable estate?

c. How much gross income must Aiden recognize, when collecting on these items?

Definitions:

British Victory

Refers to key achievements or successes won by the United Kingdom in various historical conflicts and wars, demonstrating military or diplomatic dominance.

French

Pertaining to France or its people, language, or culture.

Indian Reaction

The response or backlash from Indian communities or the nation of India to specific events, policies, or interventions.

Bourbon Reforms

A series of 18th-century administrative and economic measures implemented by the Spanish Crown to improve the efficiency and profitability of its colonies.

Q1: The constitutional amendment passed by Congress in

Q11: Summarize conflicting views on the scope of

Q24: The Constitution grants the power to directly

Q32: Harold Lasswell's definition of politics is<br>A)"who gets

Q33: Which statement is correct as to the

Q43: Circular 230 requires that a paid tax

Q61: What opportunities and challenges do emergent communication

Q70: For both the Federal gift and estate

Q77: Cash donation to the reelection campaign of

Q91: According to hyperpluralists,the increasing caseloads of federal