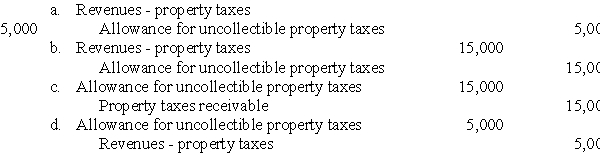

A city uses the allowance method to provide for uncollectible property taxes.At the start of the year,the city established an allowance of $100,000 for uncollectible taxes.During the year,it wrote off $80,000 as uncollectible.At year-end,the city still has some uncollected taxes,but believes it will need an allowance of only $15,000 to cover any receivables that it may need to write off as uncollectible.What adjusting entry should it make?

Definitions:

Net Operating Losses

Financial losses that a company reports when its operating expenses exceed its revenues, which can be used for tax relief.

Tax Liability

The total amount of tax owed to the tax authorities by an individual, organization, or company at any given time.

Optimal Size

Optimal size is the most efficient scale of operation for a firm where it can minimize its cost and maximize its profitability.

Synergy

The concept that the combined value and performance of two companies will be greater than the sum of the separate individual parts.

Q1: A county borrows cash on a short-term

Q4: To what does basis of accounting refer?<br>A)whether

Q8: At what point are revenues recognized in

Q11: Which of the following best describes the

Q20: A protective put can be profitable during

Q20: Which of the following statements is false?<br>A)Depreciation

Q24: (Assessment of a hospital's accounts receivable collection

Q24: In the statement of fiduciary net position

Q28: One of the variables that influences the

Q33: When a not-for-profit entity's funds are classified