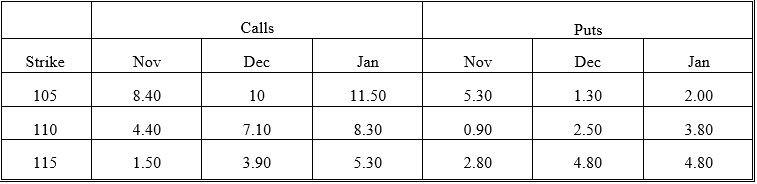

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the December 115 put?

Definitions:

Payoff Table

A tabular representation of the outcomes for each combination of strategies in decision theory, typically used in strategic decision making and game theory.

States of Nature

Hypothetical conditions that could affect the outcome of a decision or experiment but are beyond the control of the decision-maker.

Decision Alternatives

Possible actions or choices available to decision-makers in a decision-making process.

Opportunity Loss

The loss of potential gain from other alternatives when one alternative is chosen.

Q2: Receiver swaptions allow a firm to receive

Q10: The most common tests used to detect

Q12: An American call should be exercised early

Q15: The maximum loss on a call purchase

Q16: The dollar value of a one basis

Q26: Which of the following financial statements

Q28: The options market is regulated by the

Q30: Which of the following is an appropriate

Q30: Which line item does not properly belong

Q35: The opportunity to lock in the invoice