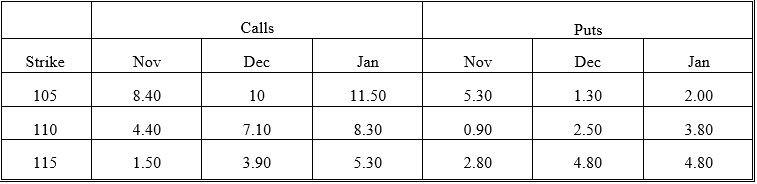

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the November 105 put?

Definitions:

One-sample Chi-square

A statistical test used to determine if a sample data matches a population with a specific distribution.

Goodness-of-fit Test

A statistical test used to determine how well observed data match the expected distribution or model.

Test of Independence

A statistical method used to determine whether two categorical variables are independent of each other.

Nonparametric Test

A different phrasing for nonparametric statistics, these are tests used for analyzing data when the assumptions for parametric tests cannot be met, focusing on the ranks or orders of the data.

Q1: Which of the following statements about an

Q1: Early exercise is a disadvantage in which

Q20: If the stock pays a specific dollar

Q26: The largest revenue source in a city

Q27: Which of the following pairs of accounts

Q32: What is the hedge ratio if the

Q32: A call bear spread is a strategy

Q34: The level of the stock is irrelevant

Q40: Find the forward rate of foreign currency

Q48: The relationship between the volatility and the