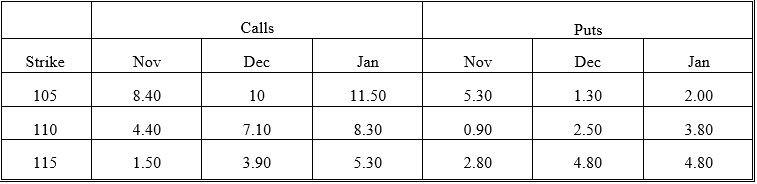

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the January 110 call?

Definitions:

Estimated Entry

An accounting entry made to record expected but not yet realized financial transactions or adjustments.

Net Realizable Value

The estimated selling price in the ordinary course of business, minus any costs reasonably expected to be incurred in completion, transportation, and selling.

Gross Accounts Receivable

The total amount owed to a business by its customers before adjusting for any allowances for doubtful accounts.

Allowance for Doubtful Accounts

A contra-asset account that represents the amount of receivables a company does not expect to collect.

Q1: Speculation is equivalent to gambling.

Q3: Which of the following transactions does not

Q12: Factor VIII inhibitors:<br>A) Are associated with thrombosis<br>B)

Q16: The equity of a company with leverage

Q20: In which city did organized option markets

Q26: The City of Maysville's General Fund balance

Q36: The General Fund provides a recurring annual

Q44: Fed fund futures arbitrage is based on

Q45: The payoff to the holder of a

Q50: A spread that is profitable if the