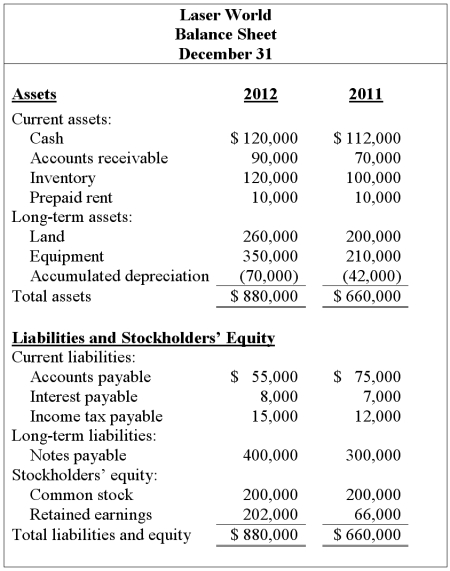

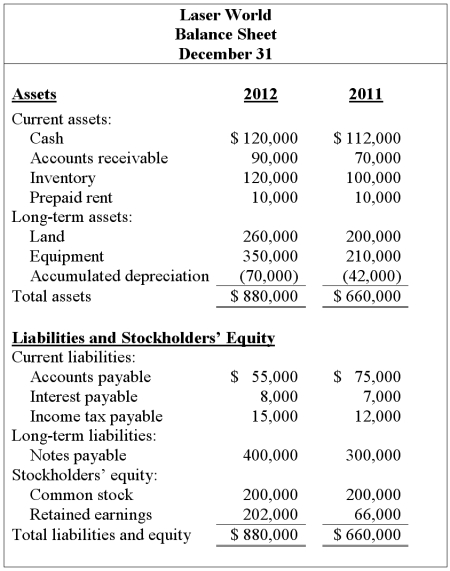

The following income statement and balance sheets for Laser World are provided:

Laser World Income Statement For the year-ended December 31, 2012 Sales revenue Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income $2,200,0001,500,000700,000350,00070,0005,00025,00060,000510,000$190,000

Assuming that all sales were on account,calculate the following risk ratios for 2012:

1. Receivables turnover ratio 2. Average collection period 3. Inventory turnover ratio 4. Average days in inventory 5. Current ratio 6. Acid-test ratio 7. Debt to equity ratio 8. Times interest earned ratio

Definitions:

Cost-Volume-Profit

Analysis that examines the effects of changes in costs and volume on a company's profit.

High-Low Method

An accounting technique used to estimate the fixed and variable costs associated with producing goods or services by analyzing the highest and lowest levels of activity.

Variable Cost

Costs that vary directly with the level of production or volume of output, such as materials and labor directly involved in manufacturing.

Scatter Diagram

A graphical representation used to show the relationship between two variables, often to identify potential correlations or patterns.