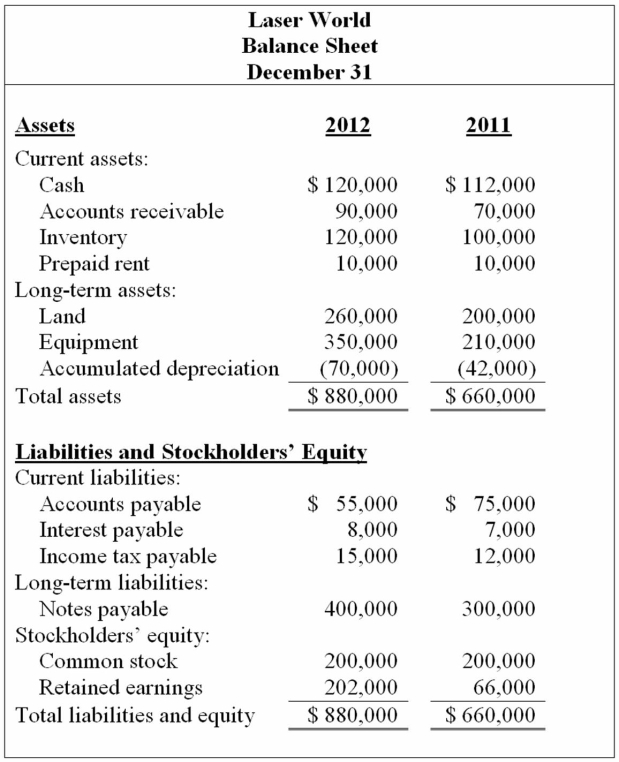

The following income statement and balance sheets for Laser World are provided:

Earnings per share for the year-ended December 31,2012,is $1.90.The closing stock price on December 31,2012,is $30.40.

Calculate the following profitability ratios for 2012:

Definitions:

Reactance Value

A measure of the opposition that a circuit presents to a change in voltage or current due to its capacitance or inductance.

Frequency

The number of complete oscillations or cycles per unit of time, typically measured in hertz (Hz).

Countervoltage

A voltage that opposes the primary voltage source in a circuit, often referred to as back EMF (Electromotive Force).

Capacitive Reactance

The resistance that a capacitor offers to the flow of alternating current (AC) in an electrical circuit, which varies inversely with the frequency of the current and the capacitance of the capacitor.

Q4: During 2012,Victoria Group: (1)received cash of $5,000

Q5: The fibrinogen group of coagulation factors include:<br>A)

Q15: The statement of stockholders' equity shows<br>A)Only the

Q16: No journal entry is made to record

Q27: In the prothrombin test, the patient's citrated

Q70: On March 31,the board of directors of

Q106: A company issued 1,000 shares of $1

Q112: How would the carrying value of

Q121: We report the purchase of stock in

Q134: Which of the following is not a