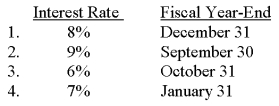

Assume that on July 1,2012,Togo's issues a $2 million,one-year note.Interest is payable at maturity.Determine the amount of interest expense that should be recorded in a year-end adjusting entry under each of the following independent assumptions:

Definitions:

Collections

The process of pursuing payments of debts owed by individuals or businesses, often conducted by creditors or assigned collection agencies.

Patent Amortization

The gradual expensing of the cost of a patent over its useful life, reflecting the consumption of its economic benefits over time.

Accounts Receivable

Money owed by customers to a company for products or services that have been delivered or used but not yet paid for.

Common Stock

Equity ownership in a corporation, with rights to vote on corporate matters and receive dividends.

Q7: Providing employees with appropriate guidance to ensure

Q22: Which of the following are included in

Q50: The return on equity measures the ability

Q75: A contingent liability is an existing,uncertain situation

Q92: Regarding a contingent liability,when no amount within

Q95: The return on assets is calculated as:<br>A)Net

Q96: When accounts payable decrease,cash paid to suppliers

Q114: Common examples of cash equivalents include all

Q127: In testing for recoverability of an operational

Q145: When a firm develops a trademark internally