Use the following to answer questions:

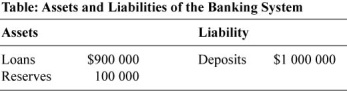

-(Table: Assets and Liabilities of the Banking System) Refer to Table: Assets and Liabilities of the Banking System.Suppose that the reserve ratio is 10% and the Bank of Canada sells $66 700 worth of Canadian Treasury bills to the banking system.If the banking system does NOT have any excess reserves,_____ will be _____ the money supply.

Definitions:

Selling

The process of promoting and transferring ownership of a product or service to customers in exchange for money or value.

Administrative Expenses

Costs related to the general operation of a business, including salaries of executives, office supplies, and utilities.

Direct Labor

The wages paid to workers directly involved in the production of products or the delivery of services.

Planning Budget

A budget prepared at the beginning of the budgeting period, reflecting expected revenues and expenses based on forecasted levels of operations.

Q23: Money is neutral in _ since it

Q67: If the marginal propensity to consume is

Q138: Bonds of the Canadian government that mature

Q151: When the Federal Reserve uses quantitative easing,it

Q188: In the long run,changes in the money

Q204: A bank's capital is the:<br>A) sum of

Q211: Social insurance :<br>A) is implicit liabilities.<br>B) is

Q299: (Scenario: Money Supply Changes)Refer to Scenario: Money

Q366: If a bank has deposits of $10

Q404: Banks' assets tend to be less liquid