Use the following to answer questions:

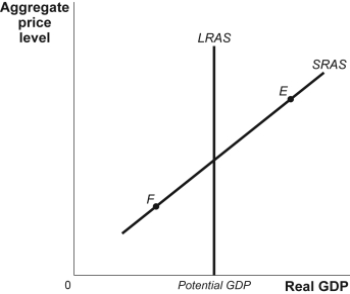

Figure: Aggregate Supply

-(Figure: Aggregate Supply) Refer to Figure: Aggregate Supply. At point F, potential output is _____ than actual output and unemployment is _____.

Definitions:

Producer Surplus

The difference between the amount producers are willing to sell a good for and the actual market price they receive, reflecting the benefit to producers from selling at a higher price.

Tax

A fundamental fiscal obligation or alternative sort of levy placed upon a taxpayer by a government power, promoting government funding and assorted investments in public infrastructure.

Consumer Surplus

The difference between the maximum price a consumer is willing to pay for a good or service and the actual price they do pay, reflecting the economic benefit obtained by consumers.

Tax Revenue

Tax revenue represents the income that a government receives from taxing individuals and businesses within its jurisdiction.

Q2: If policy makers want to increase real

Q12: In Japan during the 1990s,_ policies were

Q28: A negative supply shock raises production costs

Q51: A negative demand shock,holding everything else constant:<br>A)

Q82: (Figure: Fiscal Policy II)Refer to Figure: Fiscal

Q135: Public debt is:<br>A) taxes minus government purchases

Q149: When the price level increases,firms in perfectly

Q158: The economy is self-correcting in the long

Q192: As a country's public debt grows,the portion

Q194: In a closed economy,investment spending,I,must equal:<br>A) GDP