Use the following to answer questions:

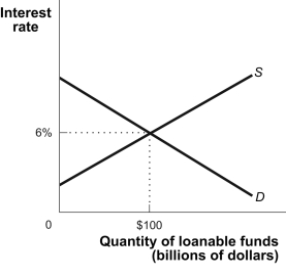

-(Figure: Loanable Funds) Use Figure: Loanable Funds. Which scenario might produce a new equilibrium interest rate of 8% and a new equilibrium quantity of loanable funds of $75 billion?

Definitions:

Foreign Currency Approach

A method of assessing and managing the risks associated with changes in foreign exchange rates.

Capital Budgeting

The process used by organizations to evaluate and select major investment projects based on their potential to generate additional profits.

Dividends

Return on capital of corporation paid by company to shareholders in either cash or stock; payments made out of a firm’s earnings to its owners, either in cash or stock.

Foreign Subsidiary

A foreign subsidiary is a company owned or controlled by another company, referred to as the parent company, which is located in a country different from the subsidiary.

Q58: (Figure: The Aggregate Consumption Function and Planned

Q75: An economy is efficient if it is:<br>A)

Q77: The changes in the economy of Finland

Q111: When a market is in equilibrium:<br>A) a

Q131: The problem of scarcity is confronted by:<br>A)

Q152: When the Calgary city manager faces a

Q169: Changes in short-run aggregate supply can be

Q194: Which of the following policies will shift

Q200: Which source(s)provide(s)funds for Amazon's investment spending?<br>I.investors who

Q322: (Figure: AD-AS)Refer to Figure: AD-AS.Suppose that initially