At the end of the fiscal year, the following adjusting entries were omitted:

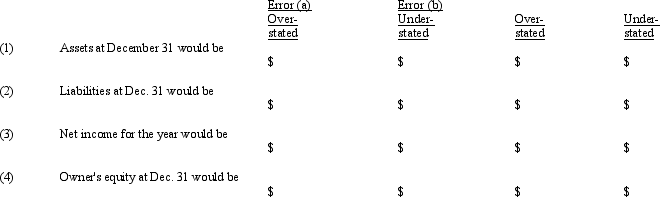

Assuming that financial statements are prepared before the errors are discovered, indicate the effect of each error, considered individually, by inserting the dollar amount in the appropriate spaces. Insert "0" if the error does not affect the item.

Assuming that financial statements are prepared before the errors are discovered, indicate the effect of each error, considered individually, by inserting the dollar amount in the appropriate spaces. Insert "0" if the error does not affect the item.

Definitions:

Excise Tax

A tax applied to specific goods, services, or activities, either as a flat amount per unit or as a percentage of the price, used to raise revenue or discourage consumption.

Output

The total amount of goods or services produced by a business, industry, or economy within a specific period.

Producers

Entities or individuals that create goods or services for sale or exchange in a market.

Market Situations

Relates to the various conditions or scenarios under which markets operate, influenced by factors like competition, demand, and supply.

Q27: The net income reported on the income

Q44: Purchased goods in transit, shipped FOB destination,

Q71: Journalizing transactions using the double-entry bookkeeping system

Q90: Which are the parts of the T

Q96: The revenue recognition concept<br>A) is not in

Q107: Adjusting entries are<br>A) the same as correcting

Q112: Marcus Enterprises was started by Damien Marcus

Q115: The following two situations are independent of

Q152: Vertical analysis is useful for analyzing financial

Q184: On March 1, 2014, the amount