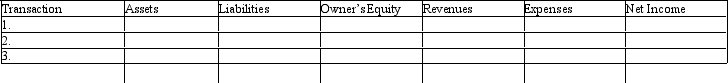

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, owner's equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Definitions:

Reserve Requirements

The minimum amount of funds that a bank is required to hold in reserve, determined by central banking authorities, to ensure that the institution remains liquid.

Monetary Control

Monetary Control involves the regulation of the money supply and interest rates by central banks to manage economic stability and growth.

Open Market Operations

The buying and selling of government securities by a central bank in order to control the money supply and influence interest rates.

Excess Reserves

The capital reserves held by a bank or financial institution in excess of what is required by regulators, central bank, or other governing body.

Q39: On January 1, 2010, Cary Parsons

Q60: Unsold consigned merchandise should be included in

Q63: Discuss and describe how errors in accounts

Q78: Increases and decreases in various types of

Q88: Listed below are accounts to use for

Q91: When preparing the statement of owner's equity,

Q104: Prepare closing entries from the following work

Q108: Generally accepted accounting principles requires that companies

Q159: Accruals are needed when an unrecorded expense

Q168: Hakik Enterprises offers rug cleaning services to