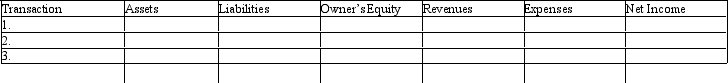

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, owner's equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Definitions:

Online Misinformation

Online misinformation involves the spread of false or misleading information via the internet, often through social media platforms.

Community Q&A Sites

Online platforms where users can ask questions and receive answers from the community members.

Content Curation

The process of gathering, organizing, and sharing information on a specific topic, typically for digital marketing or educational purposes.

Business Communication

The sharing of information between people within and outside an organization to achieve business goals and facilitate operations.

Q10: Briefly describe the three-step process of accounting

Q11: Use the following worksheet to answer the

Q53: Explain the difference between accrual basis accounting

Q69: On October 17th Nikle Company purchased a

Q83: On December 31, the balance in the

Q84: Calculate the gross profit for Jonas Company

Q100: Which of the following statements is false?<br>A)

Q157: The Balance Sheet should be prepared<br>A) before

Q159: The purchase of supplies for cash would

Q173: Merchandise with a list price of $4,200