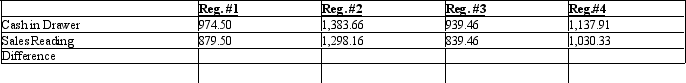

The Scharf Company is a retailer located in a state without sales tax. The following data was given to you to complete the transactions for the day's sales to be recorded. All cash drawers start with $100 in change.

Record the Journal Entries for EACH cash register to determine the cashier's accuracy.

Record the Journal Entries for EACH cash register to determine the cashier's accuracy.

First item for the student to remember is that EACH cash drawer starts with $100. This must be subtracted from the total cash in drawer to determine the cash over/short amount.

First item for the student to remember is that EACH cash drawer starts with $100. This must be subtracted from the total cash in drawer to determine the cash over/short amount.

Definitions:

Break-even Point

The point at which total revenues equal total costs, and the business makes neither a profit nor a loss.

Fixed Expenses

Fixed expenses that are unaffected by the volume of manufacturing or sales activities, and include items like rental costs, employee salaries, and premiums for insurance.

Monthly Advertising Budget

The allocated amount of spending for advertising activities planned for a month.

Net Operating Income

The total profit of a company after operating expenses are subtracted from gross profit but before interest and taxes.

Q65: Which of the following would be used

Q70: Computer equipment was acquired at the beginning

Q88: Capital expenditures are costs that are charged

Q89: A building with an appraisal value of

Q117: Journalize the following transactions:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2085/.jpg" alt="Journalize

Q118: An unfunded pension liability is reported on

Q119: One of the weaknesses of the direct

Q122: A company will most likely use an

Q123: Beginning inventory, purchases, and sales for Product

Q134: Allowance for Doubtful Accounts has a debit