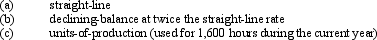

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(Round the answer to the nearest dollar.)

(Round the answer to the nearest dollar.)

Definitions:

Topic

The subject or main theme that is being discussed or considered in a conversation, document, or study.

Pro-War Messages

Communications that advocate for or support the initiation or continuation of military conflict.

Semantics

The study of meanings in language, including the meaning of words, phrases, and sentences.

Conflict

A situation or process in which individuals or groups have incompatible goals, interests, or values.

Q6: An employee receives an hourly rate of

Q10: A voucher is usually supported by<br>A) a

Q21: One of the more popular defined contribution

Q23: The salary allocation to partners used in

Q26: Watson purchased one-half of Dalton's interest in

Q77: A copy machine acquired on March 1,

Q78: Capital expenditures are costs of acquiring, constructing,

Q92: For accounting purposes, stated value is treated

Q128: The balance of the Allowance for Doubtful

Q156: It is necessary for a company to