On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

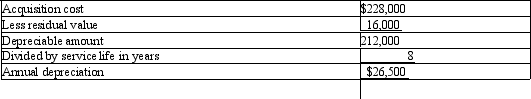

Annual depreciation is:

Definitions:

Internal Obligation

A personal sense of duty or responsibility that motivates individuals to act in a certain way without external pressure.

Social Planning Model

A method of intervention that emphasizes organized and collective action to address social issues and improve community well-being.

Community Development

A process where community members come together to take collective action and generate solutions to common problems.

Theory Y

A management concept that assumes employees are self-motivated, seek responsibility, and are creative problem solvers.

Q22: The cumulative effect of the declaration and

Q26: The current assets and current liabilities for

Q41: The amount of the outstanding checks is

Q60: What entry is required in the company's

Q65: At the end of the current year,

Q72: Quick assets include<br>A) cash; cash equivalents, receivables,

Q75: Payroll taxes only include social security taxes

Q97: When a partner withdraws from the partnership

Q103: The issuance of common stock affects both

Q141: Florida Keys Construction installs swimming pools. They