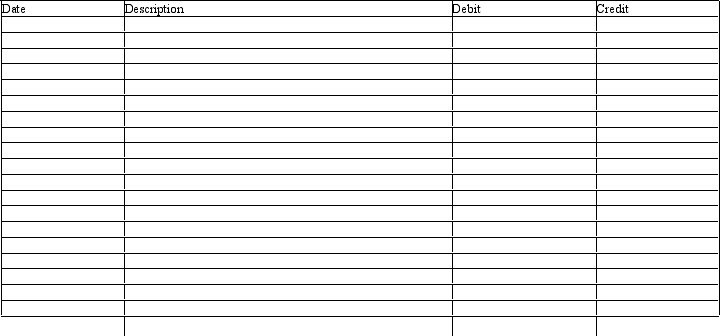

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

Definitions:

Character Analysis

A technique in psychology aimed at exploring the complexities of personality traits and behaviors.

Solution-Focused Therapists

Therapists who employ a goal-directed collaborative approach to psychotherapeutic treatment, focusing on client strengths and future possibilities rather than past problems.

Client Problems

Refers to the specific issues, concerns, or difficulties that a client presents in the context of psychotherapy or counseling.

Psychotherapy

A treatment method for mental and emotional disorders which employs psychological techniques rather than medical means.

Q8: Under the direct write-off method of accounting

Q11: Describe the features of a voucher system

Q12: A $100 petty cash fund contains $91

Q90: Based on the following data, what is

Q100: Credit memos from the bank<br>A) decrease a

Q119: The following procedures were recently implemented at

Q129: Compton and Danson form a partnership in

Q140: The process of winding up the affairs

Q162: When cities give land or buildings to

Q168: Benson and Orton are partners who share