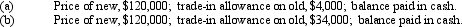

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

Definitions:

Q57: Which of the following are included in

Q63: The cost of a product warranty should

Q82: A capital lease is accounted for as

Q103: The Core Company had the following assets

Q122: Based on the following data and using

Q133: Current liabilities are<br>A) due, but not receivable

Q145: A copy machine acquired with a cost

Q149: A person may be admitted to a

Q150: List and define each of the five

Q189: Partnership income and losses are usually divided