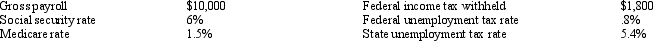

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx. Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Assuming that all wages are subject to federal and state unemployment taxes, the Payroll Taxes Expense would be recorded as:

Definitions:

Fetishistic Behavior

Engaging in sexual fantasies, practices, or objects that are non-living items or non-genital body parts for sexual gratification.

Sexual Arousal

The physiological and psychological state of excitement and readiness for sexual activity, characterized by responses such as increased heart rate, blood flow, and lubrication.

Fetishism

involves sexual fixation on a non-living object or a specific body part not typically associated with sexual activity.

Sexual Stimulation

Activities or actions that arouse sexual desire or increase sexual arousal.

Q3: On July 1st, Hartford Construction purchases a

Q12: A $100 petty cash fund contains $91

Q19: When a plant asset is traded for

Q29: At the end of the current year,

Q36: Which of the following is not true

Q107: Discuss the two methods for recording bad-debt

Q114: For income tax purposes most companies use

Q130: When the maturities of a bond issue

Q142: A fixed asset with a cost of

Q159: If nothing is stated, partnership income is