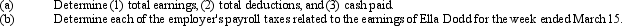

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000. Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000; on employer

Federal unemployment: 0.8% on maximum earnings of $7,000; on employer

Definitions:

Ego

Refers to the component of the mind in psychoanalytic theory, mediating between the conscious and unconscious and responsible for reality testing and personal identity.

Secondary Traits

Personality characteristics that are less consistent and more situation-specific than primary traits, often only appearing under certain circumstances.

Aggression

Behavior intended to harm or injure another individual, whether physically or psychologically.

Self-Pity

A feeling of sorrow for one's own sufferings or misfortunes, often viewed as a self-absorbed or indulgent emotion.

Q10: If sinking fund cash is used to

Q21: The receivable that is usually evidenced by

Q58: Vacation pay payable is reported on the

Q87: Both callable and non-callable bonds can be

Q94: Macon Co. acquired drilling rights for $7,500,000.

Q114: On August 1, Kim Company accepted a

Q139: Notes Receivable and Accounts Receivable can also

Q151: Journalize the following transactions using the allowance

Q152: Emerson and Dakota formed a partnership dividing

Q174: Partners Ken and Macki each have a