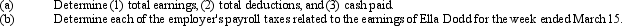

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000. Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000; on employer

Federal unemployment: 0.8% on maximum earnings of $7,000; on employer

Definitions:

Informational Reports

Documents that provide facts, data, and analysis to inform the reader about a specific topic without requiring action.

Complex Information

Data or knowledge that is intricate and complicated, often requiring specialized understanding or analysis to interpret.

Third Level Headings

Subsections within a document that are subordinate to second level headings, used to organize content in a detailed manner.

Preview Sections

Parts of a document or presentation that provide a glimpse or overview of the content that follows.

Q5: Which of the following is not a

Q34: The depreciable cost of a building is

Q78: Prior to liquidating their partnership, Porter and

Q96: A company with 100,000 authorized shares of

Q105: The bond indenture may provide that funds

Q123: For each of the following scenarios, indicate

Q131: Payroll taxes are based on the employee's

Q146: The journal entry for recording an operating

Q159: If nothing is stated, partnership income is

Q192: Xavier and Yolanda have original investments of