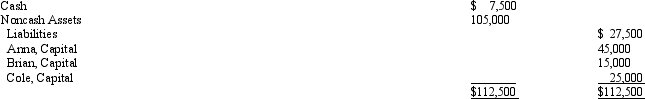

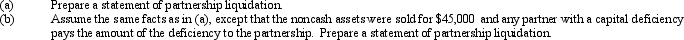

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:

The partners share net income and losses in the ratio of 3:2:1. Between May 7-30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7-30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

Definitions:

Deferred Tax Assets

Financial items on the balance sheet representing taxes paid or carried forward but not yet realized on the income statement.

Permanent Difference

A discrepancy between the tax treatment and accounting treatment of transactions and events that will not reverse in the future.

IFRS Rules

A specific set of standards and guidelines established under the IFRS framework for financial reporting and accounting.

Classified Balance Sheet

A classified balance sheet presents the assets, liabilities, and equity of a company in clearly defined categories, making it easier to understand the company's financial position.

Q2: When callable bonds are redeemed below carrying

Q47: The double declining balance depreciation method calculates

Q52: When a partnership dissolves, a new partnership

Q65: The account Unrealized Gain (Loss) on Available-For-Sale

Q71: Temporary investments such as in trading securities

Q100: Once the useful life of a depreciable

Q103: The issuance of common stock affects both

Q117: Journalize the following transactions:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2085/.jpg" alt="Journalize

Q119: Which of the following forms is typically

Q122: Mobile Co. issued a $45,000, 60-day, discounted