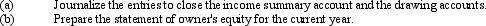

Sharp and Townson had capital balances of $60,000 and $120,000 respectively on January 1 of the current year. On May 8, Sharp invested an additional $10,000 in the partnership. During the year, Sharp and Townson withdrew $25,000 and $45,000 respectively. After closing all expense and revenue accounts at the end of the year, Income Summary has a credit balance of $90,000, that Sharp and Townson have agreed to split on a 2:1 basis, respectively.

Definitions:

Q13: Under the cost method, when treasury stock

Q53: After discontinuing the ordinary business operations and

Q58: Comprehensive income does not affect net income

Q58: The Weber Company purchased a mining site

Q70: When the market rate of interest was

Q77: Which one of the following items below

Q78: Define (1) debt securities and (2) equity

Q89: The equity method is usually more appropriate

Q126: Which one of the following would not

Q152: Organizational expenses are classified as intangible assets