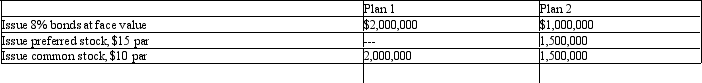

Ulmer Company is considering the following alternative financing plans:

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Required: Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Definitions:

Significant Influence

A level of control over a business entity that is less than control but more than minor influence, often indicated by owning a substantial minority of voting shares.

Net Book Value

The value of an asset after accounting for depreciation or amortization, representing its estimated current value.

Equity Income

Income derived from investments in stocks, often through dividends or profit from equity investments.

Significant Decline

A substantial reduction in value or quantity over a period, often used to describe a marked drop in financial markets, asset values, or economic conditions.

Q11: Which of the following is characteristic of

Q23: The total interest expense over the entire

Q41: One of the main disadvantages of the

Q74: Journalize the following selected transactions completed during

Q93: Which of the following is the appropriate

Q99: Equipment with an original cost of $75,000

Q110: A corporation issues $100,000, 10%, 5-year bonds

Q133: The investor carrying an investment by the

Q150: The cost of merchandise sold during the

Q168: Sabas Company has 20,000 shares of $100