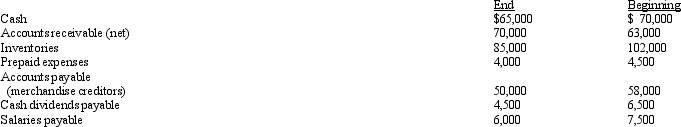

The net income reported on an income statement for the current year was $58,000. Depreciation recorded on fixed assets for the year was $24,000. In addition, equipment with an original cost of $130,000 and accumulated depreciation of $115,000 on the date of the sale, was sold for $20,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Definitions:

Contract Voided

Refers to a contract that has been declared invalid and is therefore unenforceable, as if it had never been made.

Loan Agreement

A contract between a borrower and lender outlining the terms of a loan, including repayment schedule, interest rates, and the obligations of both parties.

Interest Rate

The percentage at which interest is paid by a borrower for the use of money, or the percentage earned on a savings or investment account.

Donaghue V. Stevenson

A foundational case in modern law that established the principle of duty of care, marking the inception of modern negligence law.

Q1: Earnings per share amounts are only required

Q8: How can teachers give legitimacy to all

Q11: Jarvis Corporation makes an investment in 100

Q11: The child, Lindsay, provides an example of

Q66: The following information pertains to Carlton Company.

Q102: When the cost method is used to

Q106: The income statement for Hudson Company reported

Q122: In determining the cash flows from operating

Q154: A major disadvantage of the indirect method

Q157: If land costing $145,000 was sold for