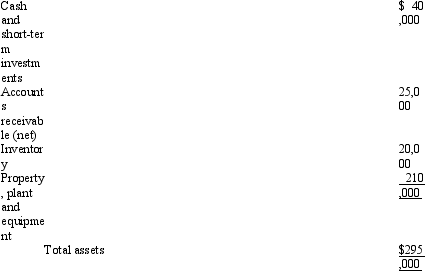

The following information pertains to Carlton Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Assets Liabilities and Stockholders' Equity

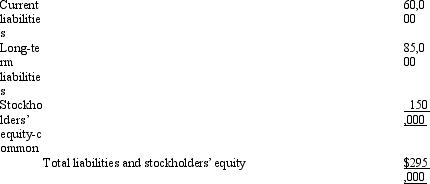

Liabilities and Stockholders' Equity Income Statement

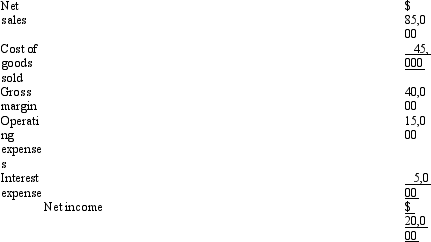

Income Statement

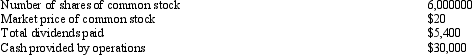

What is the dividend yield for this company? Round your answer to one decimal point.

What is the dividend yield for this company? Round your answer to one decimal point.

Definitions:

Power Of Attorney

A legal document usually signed under seal in which a person appoints another to act as his or her attorney to carry out the contractual or legal acts specified in the document.

Executing Documents

The process of signing legally-binding paperwork to formalize agreements, contracts, or decisions.

Vacation

A period of time spent away from home or work for rest, relaxation, or travel.

Need-satisfaction Selling

A sales technique that emphasizes understanding and meeting the specific needs of the client, often leading to tailored solutions.

Q2: Which of the following is not an

Q3: What is the difference between empowering and

Q8: What do people mean when they say

Q12: Which of the following is not a

Q12: Why do toddlers say "no?"<br>A) Because it

Q25: Ruben Company purchased $100,000 of Evans Company

Q45: In the Dresslar study on facial vision,

Q48: On February 12, Addison, Inc. purchased 6,000

Q56: In horizontal analysis, each item is expressed

Q142: Which of the following is required by