Use the following to answer questions:

Figure: International Capital Flows

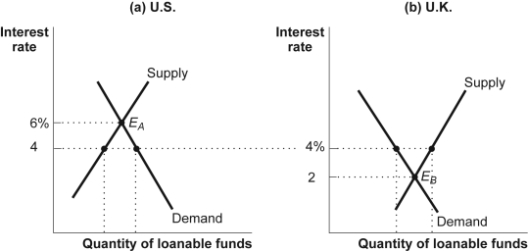

-(Figure: International Capital Flows) Look at the figure International Capital Flows. Assume that each country's equilibrium interest rate is 4%. To reconcile the apparent disequilibrium in both markets, assuming that assets and liabilities are viewed as homogeneous, capital _____ will _____ interest rates.

Definitions:

M&M II

Modigliani and Miller Proposition II; a theory on capital structure, which states that the value of a firm is independent of its capital structure, under certain assumptions.

Unlevered Cost

It refers to an investment's cost or return that does not consider the effects of borrowing or leverage.

Targeted Cost

A cost management strategy where a product's planned profit and required cost are computed by considering the competitive market price.

Debt-Equity Ratio

This ratio measures the balance between financing a company's assets with equity compared to debt.

Q6: The current account responds to changes in

Q21: The Ji, Peng, and Nisbett (2000) study

Q55: Which of the following is true about

Q56: If a number of studies all seem

Q74: Open-economy macroeconomics deals with:<br>A) reducing regulations on

Q77: During the course of an experimental that

Q87: Which of the following would be included

Q158: Suppose that the U.S. adopts a fixed

Q199: If a country with a floating exchange

Q239: Foreign exchange controls are:<br>A) fixed exchange rates.<br>B)