Use the following to answer questions :

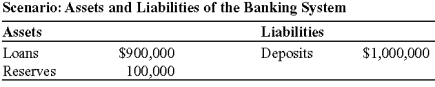

-(Scenario: Assets and Liabilities of the Banking System) Look at the scenario Assets and Liabilities of the Banking System. Suppose that the reserve ratio is 10% and the Federal Reserve sells $11,000 worth of U.S. Treasury bills to the banking system. If the banking system does NOT want to hold any excess reserves, _____ will be _____ the money supply.

Definitions:

Distribution Point

A location from which goods are distributed to consumers or retailers, acting as an intermediary node in the supply chain.

Mathematical Technique

A method or procedure employed in solving mathematical problems or in modeling real-world phenomena using mathematical concepts.

Labour Cost

The total expenditure incurred by employers to compensate the workforce, including wages, benefits, and any other employee-related expenses.

Per Unit

A term used to define the cost, price, or quantity relative to a single unit of a product or service.

Q94: Banks can lend money because:<br>A) they have

Q101: (Figure: Monetary Policy III) Look at the

Q111: Which of the following is a function

Q115: The banking crisis of 1907 that preceded

Q124: Long-term interest rates apply to financial assets

Q144: For a marginal propensity to consume of

Q314: The Federal Reserve never buys U.S. Treasury

Q330: The main problem with the banking system

Q394: The Wall Street Reform and Consumer Protection

Q450: The balance sheet effect is the increase