Use the following to answer questions :

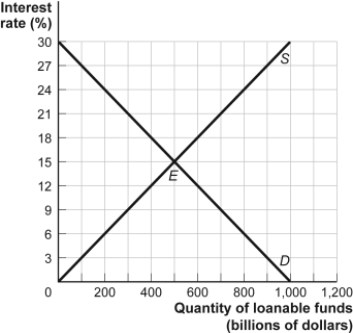

Figure: The Market for Loanable Funds III

-(Figure: The Market for Loanable Funds III) Look at the figure The Market for Loanable Funds III. If the government in a closed economy finances deficits by selling bonds and it decides to decrease defense spending by $200 billion, the equilibrium interest rate will:

Definitions:

Time To Expiration

The period remaining until the expiration date of a financial instrument, such as an option or futures contract.

Exercise Price

The price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset or security.

Stock Price

The cost of purchasing a share of a company's stock, representing the market's valuation of a single share of that company.

Time Value

The concept that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity.

Q15: Long-run economic growth will be sustainable:<br>A) because

Q51: When the government invests resources in a

Q86: Suppose the economy is in a recessionary

Q93: The convergence hypothesis says that international differences

Q96: The present value of a $110 payment

Q162: You have agreed to borrow $2,000 from

Q247: (Table: Investment Spending, Private Spending, and Capital

Q296: If real GDP doubles in 35 years,

Q300: Assume that the marginal propensity to consume

Q325: What was the main financial problem that