Use the following to answer questions:

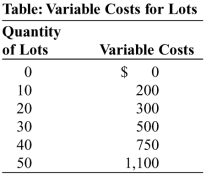

-(Table: Variable Costs for Lots) Look at the table Variable Costs for Lots. During the winter, Alexa runs a snow-clearing service in a perfectly competitive industry. Assume that costs are constant in each interval; that is, the variable cost of clearing anywhere from 1 through 10 lots is $200. Her only fixed cost is $1,000 for a snowplow. Her variable costs include fuel, her time, and hot coffee. If the price to clear a lot is $60, what is Alexa's profit per unit at the optimal output?

Definitions:

Deferred Tax

An accounting concept referring to a temporary difference between the tax expense shown in the income statement and the tax payable to the tax authorities, due to timing or methodological differences in recognizing revenue and expenses.

Income Tax Expense

The amount of money that a company or individual owes to the government based on their taxable income.

Deferred Tax Liability

A financial obligation recorded on a company's balance sheet that results from a difference in the timing of when income is earned and when it is taxable.

Q11: If a friend offers to pay you

Q32: (Scenario: Accounting and Economic Profit) Look at

Q43: A monopoly increases price by limiting the

Q65: For a firm in a perfectly competitive

Q70: (Figure: Demand, Revenue, and Cost Curves) Look

Q150: Deadweight loss in monopoly is smaller than

Q197: A perfectly competitive industry with constant costs

Q263: The United States can produce 30 computers

Q271: (Figure: Game-Day Shirts) Rick is one of

Q331: For a monopolist with a downward-sloping demand