Use the following to answer questions:

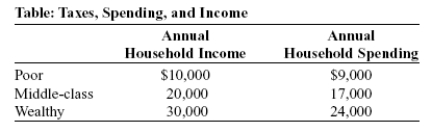

-(Table: Taxes, Spending, and Income) Look at the table Taxes, Spending, and Income. Suppose Governor Meridias decides to initiate a state tax of 5% on all sales. A poor household will spend _____ of its annual income on the sales tax, while a wealthy household will spend _____ of its annual income.

Definitions:

Commercial Grade

A level of quality or performance suitable for use in commercial applications, typically less refined or lower in quality than premium or industrial grades.

Comparative Costs

The analysis or comparison of the costs of different choices or actions to inform decision-making processes.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific products or projects based on the activities that drive those costs.

Overhead Allocation

The process of distributing overhead costs, such as rent and utilities, to different departments or products based on a certain criteria or formula.

Q15: Whenever marginal benefit is less than marginal

Q53: (Table: TC's Pizza Parlor) Look at the

Q54: Quota limits cause:<br>A) the demand price to

Q56: The benefits principle says that taxes should

Q71: (Table: Consumer Surplus and Phantom Tickets) The

Q141: (Figure: Price Controls) Look at the graph

Q164: Farmers in developing countries want the United

Q173: When there is a bountiful harvest of

Q186: (Figure: Market Demand) Look at the figure

Q215: (Table: Producer Surplus) Look at the table