Use the following to answer questions:

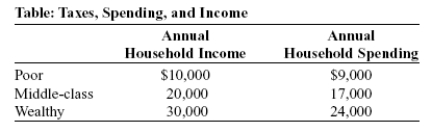

-(Table: Taxes, Spending, and Income) Suppose Governor Meridias initiates a tax of 10% on all income up to $50,000. Income above $50,000 is not taxed. An individual earning $75,000 will have an average tax rate of:

Definitions:

Adjusted

Changed or modified to reflect a more accurate valuation or account of a particular item or financial record.

Accounting Period

The span of time at the end of which a company or organization reports its financial performance and position; typically monthly, quarterly, or annually.

Net Realizable Value

The estimated selling price of goods, minus the costs of their completion and the costs necessary to make the sale.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services rendered on credit.

Q9: The price elasticity of demand measures the:<br>A)

Q26: The percentage of an increase in income

Q49: Economic analysis shows that workers pay _

Q95: (Figure: The Production Possibility Frontiers for Jackson

Q97: (Figure: The Market for Hamburgers) The figure

Q150: An effective price floor will lead to:<br>A)

Q162: When the imposition of an excise tax

Q217: A tax of $10 on an income

Q288: (Figure: The Market for Lattes) Look at

Q297: If the government decides to impose a